straight life annuity with period certain

For single employees the required form of payment is a straight-life annuity which typically provides a monthly payment based on the plan formula. Life insurance policies are generally purchased to provide coverage for an unforeseen unfortunate event like the insured persons death.

Permanent life insurance provides lifelong protection as long as you pay the premiums.

. If the formula provides 30 per month for each year of service the single. You can begin taking income immediately or defer your payments for up to a year. E elects to receive annual distributions from Plan X in the form of a 27 year period certain annuity ie a 27 year annuity payment period without a life contingency paid at a rate of 37000 per year beginning in 2005 with future payments increasing at a rate of 4 percent per year ie the 2006 payment will be 38480 the 2007 payment.

Types of Life Insurance Term Plan. Term life insurance or term insurance is one of the life insurance products that offer coverage for a specified term usually for a limited time period the applicable term. Adding the period.

Related

Learn more about term and permanent insurance. Fixed and Variable Annuities. Life insurance generally falls into two categories.

If the annuity holder dies before the end of the period the payments for the rest of that time will go a beneficiary or the annuitants estate. For this reason income payments will. In general annuities can be fixed or variable.

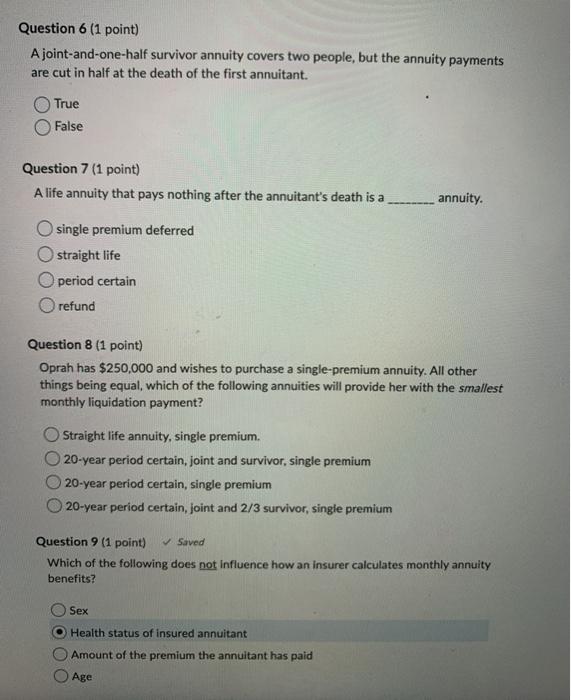

An annuity is an insurance contract in which you pay a premium to receive regular payments for a specified period of time. Because pension plans are intended to provide periodic payments for life certain forms of payment are required by law. A period certain option added to a straight-life or joint and survivor annuity means the insurance company must continue making payments after the death of the annuitant.

An immediate annuity can provide you with predictable income during retirement that you can use for essential living expenses. Any remaining principal in an annuity that is set for a fixed period of time may be refunded to the recipient or to their heirs if the annuitant has passed away. With an immediate annuity you can provide guaranteed income for life or a set period of time.

Period certain annuities are similar to straight-life annuities but they include a minimum time period for the payments say 10 or 20 years even if the annuitant dies. Term life insurance provides protection for a specific period of time the term often 10 20 or 30 years. Best Term Certain.

Upon the death of the annuitant a period certain annuity will continue providing income payments to a beneficiary named in the contract. An annuity is a contractual financial product sold by financial institutions that is designed to accept and grow funds from an individual and then upon annuitization pay out a stream. Based on the annuitants contributions over a certain period a fixed annuity pays a.

What Is A Single Life Annuity Due

Annuities From Protective Life Guaranteed Retirement Income

Annuity Beneficiaries Inheriting An Annuity After Death

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

Solved 13 Which Of The Following Is True Concerning The Chegg Com

Annuities From Protective Life Guaranteed Retirement Income

New York Life Annuity Immediate Annuity

Biscuits Annuities Shootin It Straight With Stan

Metlife Annuity Immediate Annuity

What Is A Straight Life Annuity Everything You Need To Know

Annuity Payout Options Payment Types Retireguide Com

Straight Life Annuity Definition

Life Insurance Vs Annuity What S The Difference

What Is A Straight Life Annuity Retirement Watch

Straight Life Annuity Explained In Simple Terms Due

Lifetime Annuity Calculator Newretirement

What Is A Life Annuity With Period Certain Trusted Choice

Do You Get Your Principal Back From An Annuity It Depends Approach Financial